Leave a legacy - Join the Vincent Strudwick Society

Leaving a legacy gift to Kellogg College in your will is one of the most meaningful ways to invest in the long-term development of the College and to create far-reaching opportunities for current and future students. Every legacy gift helps to transform lives and champion lifelong learning.

We’d like to extend our warmest thanks to the many members and friends who have already pledged a legacy gift to Kellogg College.

Those who make such a commitment are invited to join the Vincent Strudwick Society — a group established to thank and celebrate individuals who have so generously promised to leave a gift in their will.

Legacy Gifts make graduate study more accessible

“I would have been unable to pursue a doctorate at Oxford had it not been for my scholarship, and I am extremely grateful for this life-changing award. My experience here has equipped me with the tools to begin to see and understand the world in different ways.”

“I would have been unable to pursue a doctorate at Oxford had it not been for my scholarship, and I am extremely grateful for this life-changing award. My experience here has equipped me with the tools to begin to see and understand the world in different ways.”

Urvi Khaitan, DPhil Economic & Social History (2019-2023)

Oxford-Vincent Packford and Geoffrey Smart Graduate Scholarship recipient

“I am the first in my family to go to college. It was my dream to come to Oxford for a doctorate, and this scholarship made that dream my reality. I am truly grateful to be able to undertake my research here, and to be part of the supportive and inspiring community at Kellogg.”

“I am the first in my family to go to college. It was my dream to come to Oxford for a doctorate, and this scholarship made that dream my reality. I am truly grateful to be able to undertake my research here, and to be part of the supportive and inspiring community at Kellogg.”

Abraham Murad, DPhil Economic & Social History (2022-2026)

Oxford-Vincent Packford and Geoffrey Smart Graduate Scholarship recipient

Legacy Gifts enhance our facilities

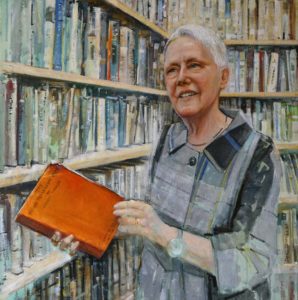

The Kate Tiller Reading Room was named after Dr Kate Tiller, who left a legacy gift to the College to support present and future students in their studies, provide access to materials, and enable students to enjoy discovering fresh and varied ideas.

The Kate Tiller Reading Room was named after Dr Kate Tiller, who left a legacy gift to the College to support present and future students in their studies, provide access to materials, and enable students to enjoy discovering fresh and varied ideas.

Dr Kate Tiller OBE, Founding and Emerita Fellow of Kellogg College

Legacy donor

Legacy Gifts contribute to sustainability and community

Legacy gifts, such as the one from renowned novelist PD James, played an instrumental role in the creation of Kellogg’s Common Room and Hub Café, the first Passivhaus-accredited building at the University of Oxford.

Legacy gifts, such as the one from renowned novelist PD James, played an instrumental role in the creation of Kellogg’s Common Room and Hub Café, the first Passivhaus-accredited building at the University of Oxford.

The Vincent Strudwick Society, named in honour of Canon Vincent Strudwick, recognises those who have chosen to leave a legacy gift in their will. Vincent, a passionate advocate for lifelong learning and the values that define Kellogg College, was one of the College’s first Fellows and played a key role in shaping the welcoming and inclusive ethos we enjoy today.

All members of the society will receive:

- an invitation to the Vincent Strudwick Society afternoon tea, hosted by the President

- a copy of Kellogg’s annual Connect magazine

- priority invitations to key College events

"Kellogg provided me with a place in which I could share a vision in the company of like-minded people, which I long to be available for future generations." Vincent Strudwick, Honorary and Emeritus Fellow

How to leave a gift in your will

Leaving a legacy gift is easily done in your will, and can be done at any stage of your life. If you have already made a will but want to make changes to it, you should not make alterations on the original document; you should either add a codicil or make a new will.

Tax advantages

Oxford University and its Colleges have charitable status as exempt charities under the terms of the Charities Act 2011. Legacy gifts to Kellogg College are therefore exempt from Inheritance Tax and Capital Gains Tax. Remembering Kellogg in your will can also reduce the amount of any tax payable out of your estate: leaving 10% or more of your estate to charity reduces the taxable threshold of your estate from 40% to 36%. Please consult your financial advisor for advice on these benefits.

Legacy giving in the US and Canada

If you live in the United States or Canada and would like more information about leaving a planned gift to Kellogg, please visit our North American Office Planned Giving webpage, or contact:

Americans for Oxford

University of Oxford North American Office

500 Fifth Avenue, 32nd Floor New York

NY 10110

Tel: (+1) 212 377 4900

Email: central@oxfordna.org

Before writing or changing your will, it is always advised to take professional advice about your own circumstances and any applicable laws. We recommend you use a solicitor who specialises in wills and probate. If you have questions about how best to proceed, we’d be happy to help! Contact us at: development@kellogg.ox.ac.uk